Most drivers do not realize that their credit history might be the cause of their high auto insurance premiums. But a new study of premium quotes provided by Louisiana Farm Bureau Insurance – the state’s fifth largest insurer – found that premiums jumped dramatically for anyone with less than perfect credit. According to insurance expert, Douglas Heller, who conducted the research, the vast majority of Louisiana insurance companies factor credit history in setting the premiums they charge, though few are as transparent about it as Farm Bureau.

As state lawmakers debate the best way to reduce auto insurance rates, the most glaring reason behind Louisiana’s high prices has been largely overlooked. While the state Commissioner of Insurance, Jim Donelon, and his chief actuary, Richard Piazza, have acknowledged that auto insurers use credit scores as a factor in determining premiums, they both attempted to downplay its significance. Yesterday, state Rep. Kirk Talbot, the author of a bill that markets itself as a “premium reduction” initiative, was evasive after being specifically asked whether a person’s credit score impacts the rates they are charged.

It is critical to note that consumers are not asking auto insurance companies for a loan; they are merely purchasing a product, as they are mandated to do under state law, for coverage in the future. In other states, the industry has attempted to justify this practice by claiming a self-selected survey they conducted asserts there is a correlation between credit scores and risk of loss. In other words, poor people pay more on the basis that poor people are more at-risk for injuries. Experts, like Heller, reject the industry’s analysis.

Consumer Reports has previously reported that several major auto insurers in Louisiana use a customer’s credit history, and nationally, they’ve revealed staggering differences in the premiums paid by people with bad credit and those with good credit, even if they have a DWI on their driving record.

While Heller based his research on publicly disclosed data about Louisiana from Farm Bureau, The Zebra, which claims to be “the nation’s most comprehensive comparison website for car insurance,” offers detailed analysis on four of the state’s six largest car insurance companies, and the differences are astonishing.

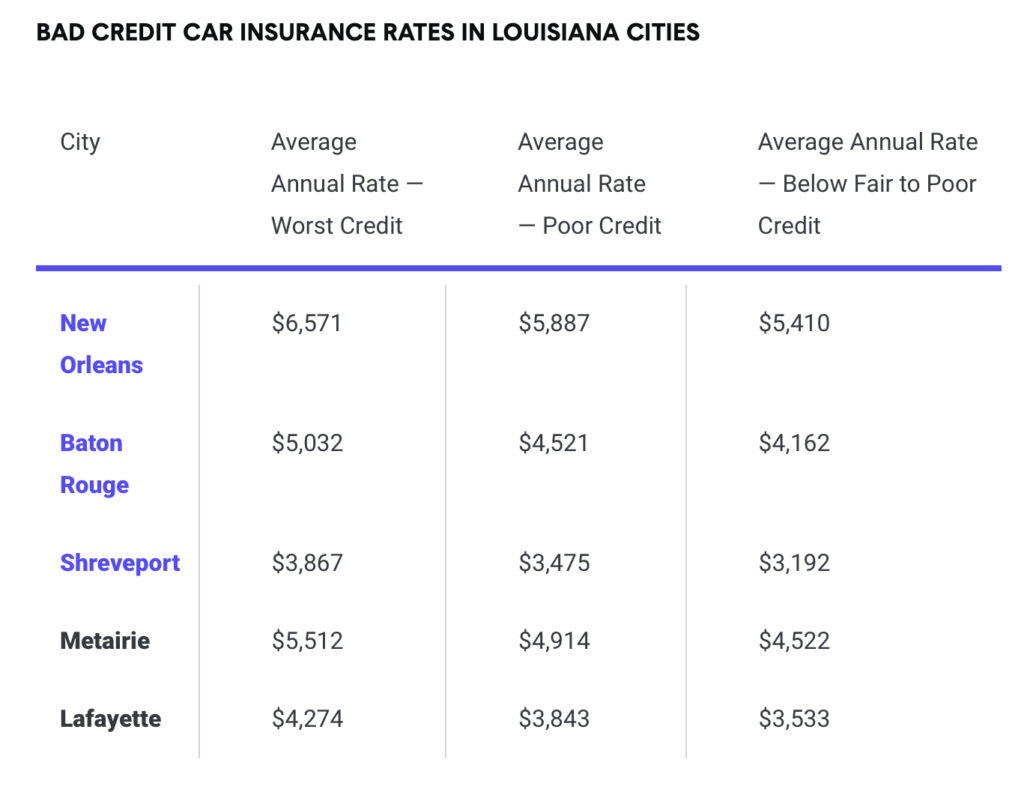

“Louisiana drivers face an average penalty of $2,026 per year for having a credit score in the ‘worst’ tier,” reports The Zebra.“Drivers in the ‘poor’ or ‘below fair to poor’ credit tiers will also pay above-average rates for a car insurance policy.”

WalletHub also revealed in its own study that drivers in Louisiana pay an average of 60% more and as much as 135% more if they have poor credit scores.

For consumers of Louisiana Farm Bureau, Heller found that premiums went up a whopping 133% for drivers with a perfect driving record but a very low credit score compared with drivers who have excellent credit. On average, low credit score drivers throughout the state are charged $1,193 more annually for basic coverage and $2,938 more for a full coverage policy, according to the research.

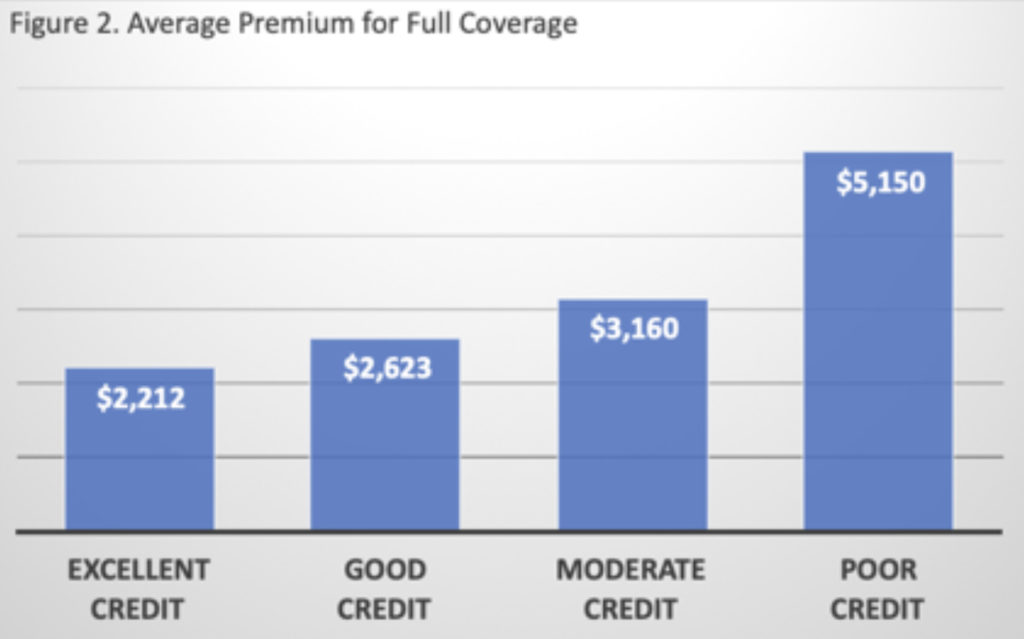

Even drivers with good credit see a 19% premium hike, while drivers with moderate credit scores face a 43% credit penalty despite their perfect driving history. Figure 1 shows average premiums for the basic, minimum limits coverage for a 35 year old male drivers with perfect records living in Shreveport, Alexandria, and New Orleans.

“If you drive safely, you should pay the same price as anyone else who drives safely, regardless of your credit score,” said Heller. “Insurance is not like a loan that you have to pay back. If you miss a payment, the insurance companies cancel you and stop providing coverage. Your credit history should not matter.”

The cost of a low credit score hit New Orleans drivers the hardest with annual premiums for basic, liability-only insurance jumping by $111 for people with only good credit, $256 for having moderate credit, and $794 for having the lowest credit score.

Three states – Massachusetts, California, and Hawaii – prohibit auto insurance companies from considering a driver’s credit history when setting premiums. In 2015, Consumer Reports Magazine placed Louisiana among the top third of states where credit history has the most impact and noted that a Louisiana good driver with Poor Credit pays $905 more on average than a driver with Excellent Credit who was convicted of drunk driving.

Louisiana Farm Bureau Insurance allows a driver to estimate his or her credit history before retrieving a quote, which at least gives a prospective customer the opportunity understand how much they are being punished for their credit history, according to Heller. Most companies require that customers provide a social security number and then obtain their credit score before providing a quote, but it’s not clear how much the credit history impacts rates. This means most people don’t appreciate that their credit can make the difference between affordable auto insurance and staggeringly high premiums.

According to the analysis conducted and published by The Zebra, Farm Bureau is not nearly the most expensive provider for those with customers with bad credit; that title belongs to Progressive, which charges, on average, $4,872 a year for comprehensive coverage for a driver with bad credit, over $1,100 that Farm Bureau Charges.

“In other states, where I’ve been able to see the algorithms insurance companies use, insurers like State Farm and Allstate sometimes charge an even higher penalty than I found testing Farm Bureau’s rates,” said Heller. “The fact that it can, because of their credit history, cost a good driver an extra $66 every month to purchase the most bare bones coverage available is not just obviously unfair and wrong, it also contributes to level of uninsured motorists in the state, which raises rates for everyone.”

In testing premiums for full coverage, in which a driver seeks higher liability protection, uninsured motorist coverage, and comprehensive and collision coverages, Heller found penalties that were in the thousands of dollars. Figure 2 shows that good drivers who fall from excellent to good credit see average premiums across the state rise by $411; moderate credit drivers pay $948 more than those with excellent credit; and safe drivers with the worst credit pay $2,938 more per year than their excellent credit counterparts.

“Louisiana lawmakers who want to make a difference in the premiums facing drivers who have had some bad luck financially but don’t cause accidents should eliminate the use of credit history in auto insurance pricing. Make insurance companies rate drivers on how they drive, not their personal financial situation,” said Heller.

There are multiple reasons the industry charges poor Louisianians more than wealthy drivers, regardless of driving record. While the industry points to a questionable set of internal surveys that attempt to make an actuarial justification, the truth, say many who have studied the industry, is that the high prices paid by the poor allow the industry to subsidize the rates the wealth pay, and unlike those with bad credit, the wealthy are much more likely to purchase additional products, such as life insurance and homeowner’s insurance, which have higher profit margins and are more expensive. The poor, in others words, are effectively subsidizing low rates for the wealthy, so that companies can better attract additional business.

Contrary to statements made recently by state legislators, a state’s “legal climate” is not a factor used by auto insurers in determining the premiums they charge.

Some argue these practices amount to the criminalization of poverty and auto insurers are allowed to judge people on the color of their collar.

But in a state with a population that is approximately 32% African American, the racial disparities are impossible to ignore. A recent study by ProPublica revealed that African Americans are often charged 30% more than whites for their car insurance; other studies assert the number could be as much as 70% higher, according to the Consumer Federation of America.

For more than a dozen years, lawmakers, regulators, and policymakers have understood that these disparities are being driven by the industry’s reliance on “credit-based insurance.”

“Insurance companies insist that credit scores are a reliable predictor of future claims and yet they have no idea whether the credit information they are using is accurate,” said Norma Garcia, then the Senior Staff Attorney with Consumers Union, in 2007. Garcia was responding to a report from the Federal Trade Commission confirming racial disparities.

“The use of credit scoring in insurance is unnecessary because insurers have a variety of remedies available to protect themselves against consumers who file too many claims. Insurers can raise premiums for those who file too many claims or even terminate claims-prone consumers,” Garcia argued.

While far-right Louisiana state legislators have parroted the false talking points offered by the industry and their lobbyists- at one point yesterday, state Rep. Ray Garofalo proudly acknowledged his belief that reforms should be based on what the auto insurance industry has demanded- the truth is that Louisiana isn’t ranked as one of the most expensive states in the country for auto liability due to any inequities in the state’s civil law system, and the proposals offered thus far will almost certainly increase consumer costs.

Louisiana’s costs are high, because the state mandates all drivers purchase auto liability coverage. And, in a state struggling with disproportionate poverty, the Insurance Commissioner has failed to ensure the marketplace isn’t allowed to be exponentially more expensive for those who can pay the least.

“It’s not just that insurance companies are overcharging Louisianians with low credit scores,” Douglas Heller notes. “It’s that the state Department of Insurance hasn’t done anything to stop companies from these egregious premium hikes on good drivers.”