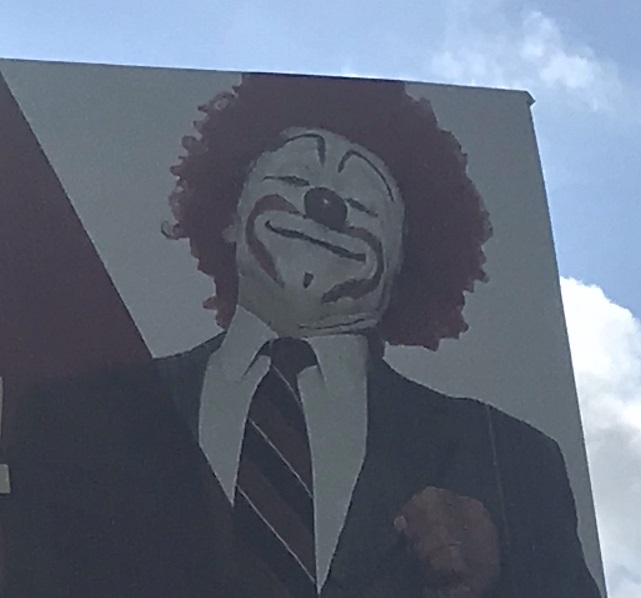

On a recent trip to visit my kids and grandkids in Lake Charles, this billboard caught my eye. There’s more than one of them, sited in view of travelers along I-10, between Jennings and Lake Charles, near the town of Iowa. Because of speeds on the interstate, thundershowers, and road construction, it was unwise and unsafe to try and get a picture as I drove through. The next day, though, a friend living nearby provided pictures of the massive sign, including this close-up.

Inquiries made to our staff and backers soon determined that no one at the Bayou Brief had known about – or been a party to – erecting these signs. But I was certainly going to ask Insurance Commissioner Jim Donelon what he knew about them, when I saw him at the Secretary of State’s office the next day, during qualifying for the October 12 election.

Before the Commissioner arrived and I could query him about the creepy clown signs, Donelon acquired a serious challenger. Tim Temple, a Baton Rouge Republican, made it clear straight off that he considers the deficiencies in the state Insurance Department and its leader no laughing matter.

“Louisiana residents spend 18% of their total income on mandatory insurance, primarily auto and homeowners. That’s the highest in the nation,” Temple stated. “The current Insurance Commissioner has had 13 years to do something, but based on the rising rates of auto insurance particularly, he is asleep at the wheel.”

Temple is the president of Temptan, LLC, a family-owned financial and real estate holding company. Originally from DeRidder, his family founded Gulf Universal Holdings, which included Amerisafe Insurance (a worker’s comp company) and the insurance firm Morris, Temple & Co. He is also a member of the Committee of 100, a group of business leaders dedicated to improving Louisiana’s long-term economic growth potential.

“Insurance is a business, and we need to ask the companies what we can change to help them lower the rates,” Temple said. “The current Insurance Commissioner has been giving us nothing but excuses for the ever-rising rates. ‘It’s the cost of repairs,’ he says. ‘It’s cheap gas. It’s distracted drivers.’ All excuses. The industry needs to be at the table, and they want to be part of the solution.”

When reporters asked Temple about the controversial “omnibus bill” which failed to pass in the 2019 legislative session, he said he is supportive of tort reform.

“Louisiana has never had an Insurance Commissioner from the insurance industry. That’s my background,” Temple said. “But unlike the current Commissioner, who gets all of his campaign money from the industry, I’m self-funded.”

According to the campaign finance reports he has filed with the Louisiana Ethics Commission, Temple has provided more than $1.1 million of his own money in order to fund his campaign. Donelon has just over $1 million in his campaign war chest.

And once the 74-year-old incumbent had paid his fees and signed up to run for his fifth term, he addressed reporters who were on the three-day stakeout of qualifiers at the Secretary of State’s office.

“I look forward to four more years,” Donelon said. “I am mindful that what I do with the stroke of a pen on a daily basis impacts people and businesses all across the state.”

Considering that three of the four Louisiana Insurance Commissioners preceeding Donelon went to prison after being convicted of federal crimes (Doug Green, Sherman A. Bernard, and Jim Brown), the Metairie Republican has had a comparatively scandal-free tenure. He’s also generated minimal challenges, until now. What does Donelon think about his competition this time?

“My wife has often said that I win because this is the worst job in the state, and no one else wants it. Apparently someone wants it badly enough to put a million dollars of their own money into the race.”

Temple’s criticisms were repeated to Donelon, who became defensive.

“I’m not asleep at the wheel,” he responded. “Auto insurance rates have gone down for half of Louisiana’s policy holders, because State Farm, Farm Bureau, and Progressive have reduced their rates.”

He continued, “There are more companies writing policies in Louisiana than ever before in our history, and we all know more competition is the best way to protect consumers.”

Donelon was asked then why, if more competition is the answer, do we still have such high rates?

A glance at his campaign manager, who was starting to glower, and you could actually see Donelon check himself, before responding with, “Litigation is the single biggest driver of rates.”

That was my opening to ask about the signs.

“Have you seen or heard about the billboards along I-10, in southwest Louisiana?”

“I’ve heard,” Donelon said, pursing his lips disapprovingly.

“What’s the story there? Any idea?” I asked.

“Those were put up by a political activist with deep pockets, and anger issues,” the Commissioner said. “I ruled against him on an appeal of a workmen’s compensation insurance case, involving $1.3 million that was owed and unpaid to LWCC. An audit showed employees were paid minimum wage, but reimbursed for excessive amounts of vehicle mileage – $95-100-thousand a year. It did not pass the smell test.”

The “political activist with deep pockets” is a member of the LSU Board of Supervisors and the current chairman of the Louisiana State Licensing Board for Contractors. The CEO of a construction firm and other companies in southwest Louisiana, Lee Mallett was also a member of the Louisiana Citizens Property Insurance Corporation Board of Directors from 2006 to 2009, the difficult years following 2005’s Katrina and Rita, and then 2008’s Gustav and Ike.

More interestingly, in 2015, Mallett gave $25,000 to Eddie Rispone’s old cause celebre’: the Louisiana Federation for Children PAC, and $30,000 to David Vitter’s Fund for Louisiana’s Future. He’s a dependable campaign contributor for John Kennedy and Jeff Landry.

To put it another way, Lee Mallett is part of the Erector Set, a courtier to the kingmakers and would-be-king. And now Mallett – and presumably the organizations and PACs where members of the Erector set wield so much power and control – appears anxious for Donelon’s defeat. And Mallett is pointing to the Bayou Brief article that told of Donelon’s less than whole-hearted support of the tort-reform bill that was masquerading as the answer to Louisiana’s exorbitant auto insurance rates.

Remember, tort reform has been one of LABI’s (the Louisiana Association of Business and Industry) policy goals for several years. And the tightest reins on LABI’s PACs are held by Lane Grigsby, Eddie Rispone’s bosom buddy.

As of the last reporting period, Tim Temple had not yet received any campaign donations from major players in the Erector Set, or from LABI’s PACs. He did, however, get the maximum donation from “Boysie” Bollinger, CEO of Bollinger Shipyards.

Donelon hasn’t gotten any money from the Erector Set or LABI, either. He has, however, been filling his campaign coffers with money from insurance companies and insurance agencies (no surprise), but also from attorneys and many, many chiropractors.

No wonder he was reluctant to put his reputation on the line by supporting the spurious premise of the Talbot tort reform bill.

For despite doing so, it seems Donelon’s hopes of re-election to a fifth term as Insurance Commissioner could as easily end in tears, as in triumphant laughter.