“When plunder becomes a way of life for a group of men in a society, over the course of time they create for themselves a legal system that authorizes it and a moral code that glorifies it.” – Frédéric Bastiat

There’s less than a month till the statewide primary elections on October 12, and the field at the top of the ticket has narrowed. Three of the nine men who signed up August 6-8 to run for Louisiana Governor were disqualified by a court decision handed down August 26. Republicans Patrick Doguet and Manuel Leach, along with Democrat “Vinny” Mendoza, will not appear on the ballot due to failure to “file income tax returns for each of the past five years.”

And while he’s not a candidate for elected office, it was announced Thursday, September 12, that the not-so-behind-the-scenes player in politics, Lane Grigsby, is being sued by the federal Department of Justice for more than three-quarters of a million dollars (+ $750,000). The Cajun Industries founder and his wife claimed and received a tax refund for “research and development expenses” incurred by the company, a refund the IRS has since disallowed. A longtime Republican powerhouse within the Louisiana Association of Business and Industry (LABI) Board of Directors, Grigsby had made one political gossip column the previous week, when it was revealed he and his family are financially supporting the state Senate campaign of Cleo Fields. Fields, who is notorious for being shown purportedly accepting a large amount of cash from Edwin Edwards in an FBI video used in the last federal court case against the former governor, is a Democrat who has not held an elected position for the past 12 years. The competitor in that state Senate race is also a Democrat, state Rep. Patricia Smith. She, on the other hand, has been vocal about her opposition to some of Grigsby’s and Rispone’s Erector Set shenanigans – most especially their involvement in the so-called “education reforms” of 2012.

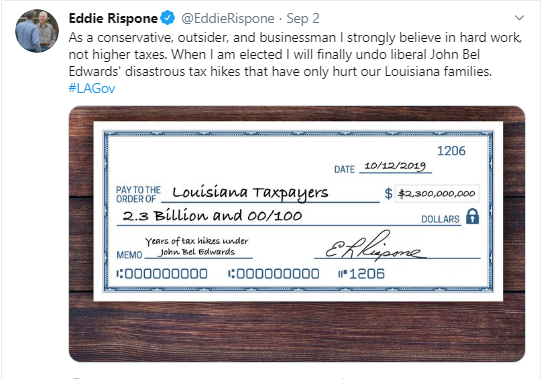

All of this got us thinking – as much as Republican gubernatorial candidate Eddie Rispone bellyaches about “liberal John Bel Edwards’ disastrous tax hikes,” Rispone always pays all the taxes he owes when they’re due, doesn’t he?

Of course he doesn’t.

Glorifying Tax Avoidance

Nobody likes paying taxes, including Rispone, a Baton Rouge-based construction industry executive and engineer who, as we have previously reported, helped engineer a way to potentially minimize his state income tax liability via the school voucher scheme. In the meantime, much of his campaign scheme focuses on blaming the Democratic incumbent Gov. John Bel Edwards for the tax policies enacted by the state’s Republican majority Legislature.

If you google “tax avoidance strategies,” you’ll get more than 8 million responses. “Tax avoidance methods” returns more than 10 million links, including the first one which states, “Tax avoidance is the use of perfectly legal methodsof minimizing your income taxliability.”

Perfectly legal. Minimizing your income tax. Good, right?

As British economist John Maynard Keynes put it,

But another Google link, to a book titled “The Glorification of Plunder: State, Power and Tax Policy” by Malcolm James, defines “tax avoidance” as “contriving transactions and structures that reduce tax in ways that are contrary to the policy or spirit of the legislation.” James goes on to clarify that there are two parts to this: one, a taxpayer must undertake transactions or create structures which have the result of reducing their tax liabilities; and two, these must comply with the strict letter of the law but contravene its intention or spirit.

There is a difference between “tax avoidance” and “tax evasion”: the first is technically legal, while the second one is a crime. Somewhere in between are tax liens that show up on the record of companies Eddie Rispone has headed and/or owns.

How many types of taxes have the now-candidate for governor and his businesses been caught not paying, and in how many places?

- There’s workmen’s comp in Ohio,

- And franchise taxes in Texas.

- There were missing city sales and use taxes in Baton Rouge,

- And a sheriff’s sale due to delinquent property taxes.

- Also, while Rispone was president of a prior company,

- The feds said Ed’s biz hadn’t paid the IRS.

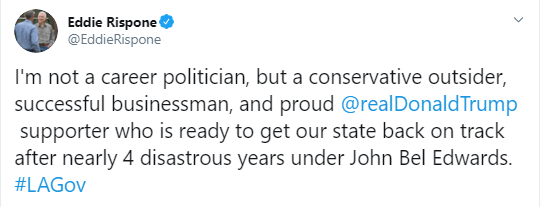

Rispone, who is primarily using ten million dollars of his own money in his campaign for governor, is running on his adoration of and devotion to Donald Trump, as well as on his personal record as a “successful businessman.”

Let’s examine the tax lien portions of that record.

In May 1987, a tax lien was filed against MMR Constructors, Inc., for $11,971.31 in unpaid 1986 federal taxes. Eddie Rispone was president of the company at the time.

As we have previously reported, Rispone’s tenure with MMR began in 1975 and ended in late 1998, followed by founding his current corporation, ISC Constructors, in early 1989. It certainly appears Rispone made sure to take care of the federal tax lien before leaving MMR, as the records show the lien was satisfied and released January 15, 1988.

Rispone was president of MMR Constructors, a wholly-owned subsidiary of MMR Holdings. He held the title of vice president with the parent company, and the timing of his escape from entanglements with MMR remains remarkably convenient.

Consider: from April through July of 1988, Rispone sold off some 27,000 shares of MMR stock. He says he did so upon the advice of his great friend Lane Grigsby, the CEO of Cajun Contractors., and used the funds to found ISC in early 1989.

However, in November 1988, MMR Holdings and its president James Rutland were indicted in federal court for alleged bid-rigging of the 1981 Cajun Electric power plant contract. Rutland and MMR were convicted; MMR Holdings went into bankruptcy; and the stock, which Rispone had sold for an average price of $15.75 per share in spring and summer 1988, was valued at less than 19 cents per share by the end of 1990. And, according to SEC filings, “As of February 1, 1991, there were 5,677,417 shares of common stock outstanding. There is no current market for the common stock.”

One might reasonably excuse Eddie from the taint of responsibility for the criminal activity by MMR, as he was merely president of one of its subdivisions, and not the owner. Yet ISC Constructors, the company Eddie does own, has not been without its share of tax troubles here, there, and everywhere, starting a few years following its founding in early 1989.

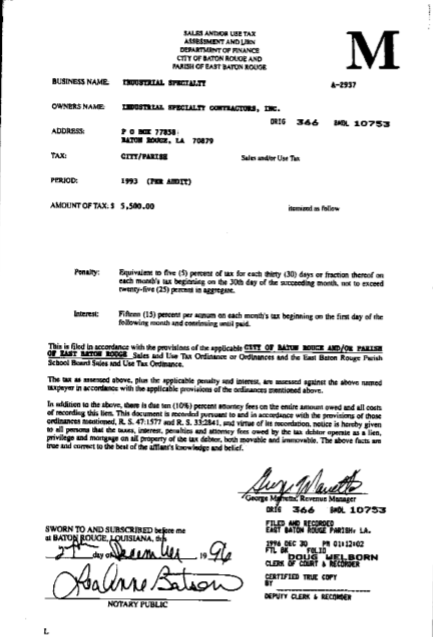

In 1993, a Baton Rouge city/parish audit cited Rispone’s company for non-payment of sales and/or use tax, and on December 30, 1996, a $5500 lien was filed against “Industrial Specialty Contractors, Inc.,” as it was then called. The delinquent taxes were paid off and the lien lifted on July 15, 1997.

Since 2013, ISC, using the state-administered Enterprise Zone program, has been allowed an annual $6000-per-year credit against the sales and/or use taxes the company would otherwise owe to Baton Rouge city/parish government.

That’s because of “quality jobs” creation, you see. In the case of this particular Enterprise Zone program approval, it was five jobs, with a combined total five-year payroll of $292,500. Broken down, that means each of these “quality jobs” pays $11,700 annually. If that’s full-time, that means these workers are making $5.85 per hour – well below the $7.25 federal minimum that has been the law since July 2009.

We’ve previously reported on some the troubles Rispone’s company has had in Texas, including three major class-action lawsuits alleging violations of the federal Fair Labor Standards Act. Those lawsuits have been settled, and ISC continues to do projects in Texas, with business offices in Houston and Beaumont.

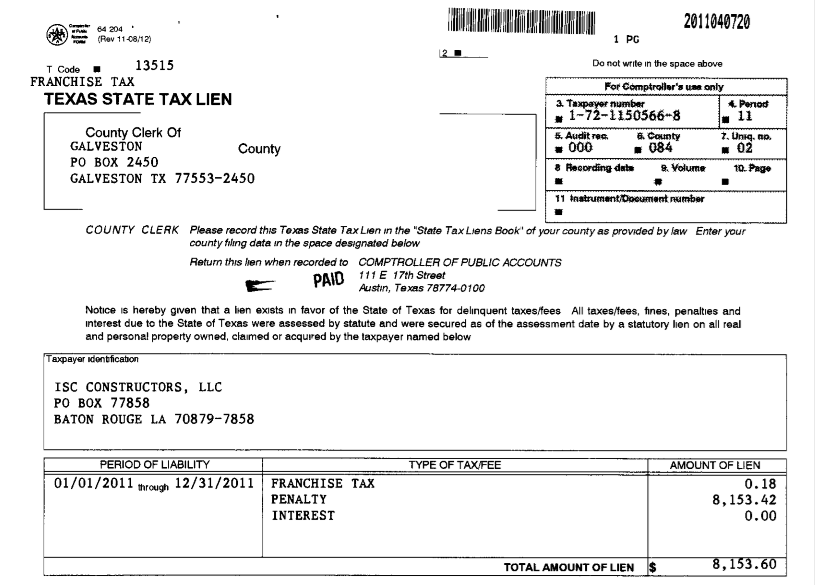

But in 2011, ISC got hit with a lien in Galveston County, Texas, for failure to pay Texas franchise tax. That tax is described on the state Comptroller’s website as “a privilege tax imposed on each taxable entity formed or organized in Texas or doing business in Texas.” It’s only assessed on big business, as it doesn’t kick in until gross receipts exceed a million dollars. Then the tax equals one percent of the gross receipts over $1,000,000. ISC’s lien was for $8,153.60.

To be fair, $8,153.42 of that was the penalty for failure to pay…the 18 cents actually owed in unpaid franchise tax. It was paid in full September 16, 2011.

Two years previously, Rispone’s ISC Constructors incurred not one, but two tax liens in Ohio – for failure to pay for Workmen’s Comp insurance coverage.

The first lien, for $939.15, was issued January 10, 2009. A second lien, for $5,056.06, was issued June 20, 2009, and were registered with the Clerk of Court for Franklin County, which includes Ohio’s capital city, Columbus. (That is like the process here in Louisiana, where proceedings involving state government have to be filed in state court in East Baton Rouge Parish, the jurisdiction of record for the state capital.)

Currently, Franklin County has no records of the liens being settled or released, showing that they have been referred to the Ohio Attorney General’s Office, which ISC must contact in order to resolve the lien.

It’s entirely possible Eddie Rispone and/or ISC Constructors’ accountants don’t even know about these Ohio liens.

According to information provided on-line by the Franklin County Law Library, “The existence of Ohio tax liens (also called judgment liens) can come as a surprise. Unless a taxpayer responds to the initial 60-day notice letter, informing him or her that taxes are past due, the Ohio Department of Taxation will contact the Attorney General’s Office, who will file a certification of the tax assessment with the Clerk of the Common Pleas Court, who will enter a judgment against the taxpayer.”

The website info goes on to say the Court does not collect the tax. It must be paid to the State of Ohio, through the Attorney General’s Office. And once the lien has been certified by the Ohio A.G. as satisfied, it’s up to the taxpayer to provide that certification proof to the Court, and then pay any additional court costs due there.

But, hey – altogether it’s less than $6000, and it’s in Ohio, not Louisiana. It’s against Rispone’s company, not Eddie himself. And the address they’ve got is a P.O. Box, not the physical street address.

However, in 2008, Rispone nearly lost the property at the actual physical street address of what is now his company headquarters.

On June 2, 2008, a sheriff’s tax sale was held to auction off the 5+ acres of property at 20480 Highland Road in Baton Rouge, due to delinquent property taxes in the amount of $25,195.72. On June 20, 2008, the East Baton Rouge Parish Clerk of Court filed a tax deed, transferring ownership of “the whole of the property…with all the improvements thereon” to R.E. Concepts, LLC, a company based in Metairie.

Title to the property, which had been owned by ISC since 1989, was returned to ISC Properties LLC via a deed of trust registered September 5, 2013.

It wasn’t cheap to get it back. The records show although the market value of the entire property – over 5 acres, more than 66-thousand square feet of office space, parking lots, etc. – was stated to be $2.6 million, ISC took out a mortgage for $6.75-million, at 18% interest.

If elected Louisiana Governor, what will Eddie Rispone’s “successful” business practices cost us?