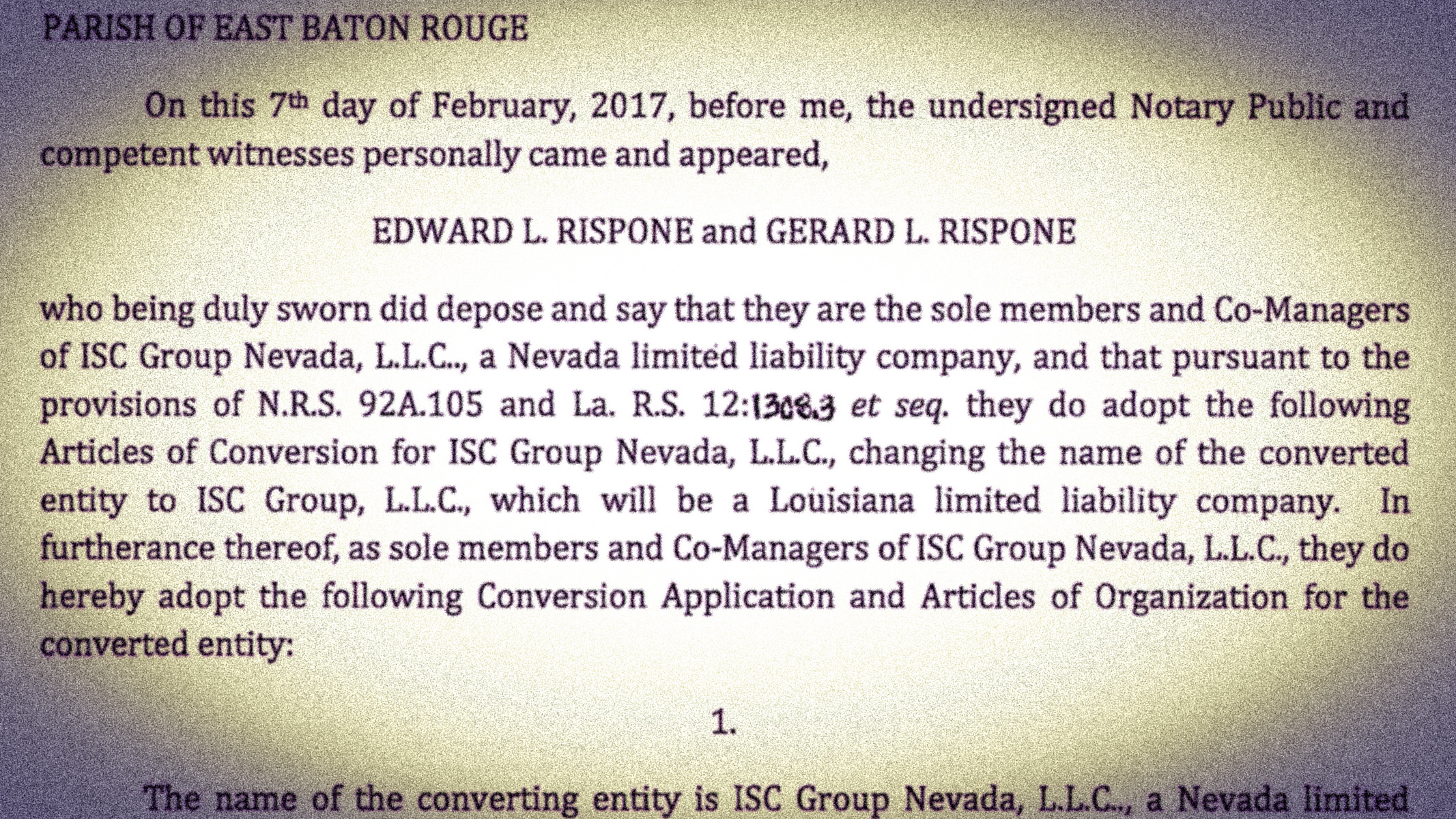

For more than fifteen years, from December of 2001 until February of 2017, Eddie Rispone and his brother Gerry used a limited liability company they created in the state of Nevada, ISC Group of Nevada LLC, to maximize their control over and potentially avoid paying taxes on wealth generated by their Louisiana-based company ISC Constructors, according to documents filed with both the Nevada and Louisiana Secretaries of State by their attorney, Loren Kleinpeter of Baton Rouge.

The Bayou Brief obtained and reviewed both sets of documents, totaling 53 pages, on Monday, after discovering late last week a series of entries under Rispone’s name listed on the Nevada Corporations Database.

Rispone quietly “converted out” the Nevada company to a newly-formed Louisiana entity, ISC Group (of Louisiana) LLC, around 15 months before it became publicly-known that he was preparing to launch a campaign for governor. Subsequently, he claimed that, prior to declaring his candidacy, he and his “political mentor,” Lane Grigsby, had been attempting to recruit a Republican to challenge incumbent Gov. John Bel Edwards.

Today, ISC, which stands for “Industrial Speciality Contractors,” uses the domain www.iscgrp.com as its primary address online. The company provides “safe, high quality electrical, instrumentation and controls solutions to global leading industrial manufacturers” and maintains offices in Baton Rouge, Lake Charles, Beaumont, and Houston, according to its website.

The Bayou Brief has previously published a series of exclusive reports about the Rispone family business, which has an estimated worth of between $202.6 to $312.1 million according to publicly-available information on its annual revenue and profit.

The company has benefitted as a subcontractor on projects that have received more than a half of a billion dollars in tax exemptions and credits, and among other things, Rispone was directly responsible for spearheading the passage of a law allowing his donations to a Catholic-run voucher school operator to count as money he would otherwise owe in state income taxes.

Until now, no one has reported on his business in the Silver State, and Rispone has not mentioned the Nevada company at all during his campaign.

What Happens in Vegas (or Reno or Carson City) Stays in Vegas (or Reno or Carson City):

Nevada, like Delaware and Wyoming, is notorious as a tax haven for the super-rich, who frequently (and legally) take advantage of its laissez-faire laws on businesses to transfer their assets from the states in which they actually reside. Only two months before Rispone transferred his Nevada LLC to the Louisiana entity, the release of the Panama Papers generated renewed attention on the proliferation of shell companies during the past two decades and the complete lack of regulatory oversight.

All told, Nevada had allowed more than 20,000 foreigners to create shell companies, conceal their true identities, and avoid paying billions of dollars they would have otherwise owed in taxes. At the time, Nevada lawmakers had been considering a series of reforms aimed at increasing accountability and transparency, though they ultimately did not materialize.

“Nevada’s infamously lax incorporation laws allow anyone — terrorists, sex traffickers, arms dealers, Putin, people who want something from a corrupt president, etc. — to set up a shell company,” reported Hugh Jackson of the Nevada Independent in April of 2017, ”not only to hide one’s identity, but also to avoid taxes or move dirty money around.”

The U.S. Senate is currently considering bipartisan legislation approved by the House to require the true owners of such companies to disclose their identities. Notably, Rispone’s name had always appeared on the documents filed in Nevada.

There is no evidence, however, that ISC Group of Nevada LLC ever provided services or performed work on a project in the state. The most recent Nevada address listed for ISC Group of Nevada LLC was the backdoor of the Ferris Mansion in Carson City; its agent was the Corporation Trust Company, a wholly-owned subsidiary of the global information behemoth Wolters Kluwer and the largest resident agent service company in the world. Prior to that, it had been domiciled in Reno at an address that is linked to at least one foreign-owned shell company that became ensnared in the controversy surrounding the Panama Papers.

The company that had served as Rispone’s resident agent in Nevada is currently led by John Weber, a successful trial lawyer.

Knocking on Haven’s Door:

Decades before it became a tax haven and before it was an international gambling destination, Nevada was well-known for doling out marriage licenses in Las Vegas and divorces in Reno faster than anywhere else in the world. Three of President Franklin D. Roosevelt’s children traveled to Nevada in order to officially and quickly call things off with their spouses, as did a number of celebrity actors, writers, and musicians. The state’s willingness to make things easier for non-resident divorcees helps explain, in part, the decision to welcome in a torrent of businesses that exist entirely on paper.

“In 1991, Nevada opened the doors to rapid incorporations with the goal of becoming the ‘Delaware of the West,’ a reference to the Atlantic Coast state with a century-old history of serving as the legal home of thousands of U.S. corporations,” explained Tim Johnson of McClatchy. “Attempting to lure business, Nevada boasted of its lack of a personal or corporate income tax and guarantees of privacy.”

The precise value of Rispone’s holdings in Nevada remain unclear, but because his shares were moved to a new Louisiana company and because that company then became a member of ISC Constructors, they likely total in the millions, according to three business valuation experts who spoke with the Bayou Brief on background.

Rispone has claimed ISC Constructors generates more than $300 million a year in revenue, though that may only represent the most the company has made in a single year. He also has asserted ISC employs more than 2,800 people, which experts say seems dubious considering the company primarily relies on temporary labor for construction projects. (ISC has also used the term “associates” to describe its workforce). Regardless, though, Rispone’s company has been enormously successful, particularly during the past four or five years as a surge of industrial construction projects in Louisiana and Texas have broken ground.

Thus far, in his campaign for Louisiana governor, Rispone has personally spent at least $11.5 million; it is expected, however, that he will eventually be able to recover around half of the money through outside donations.

In addition to the business valuation experts, the Bayou Brief spoke with two attorneys who specialize in tax law. There is nothing necessarily illegal with creating a shell company in Nevada to avoid taxes, they said, but both argued that the arrangement poses legitimate and inherent questions about the ethics of wealthy business owners who move a portion of their assets to tax havens with which they otherwise have no connection.

Those questions are particularly relevant when the business is owned or controlled by an elected official or a candidate seeking elected office, and they become even more problematic and important if that official or candidate has also been the beneficiary of tax exemptions and credits.

By housing a portion of his assets in Nevada, Rispone could have avoided paying some of what he would have otherwise owed in franchise taxes (at least until recently), business income taxes, fees on the company shares, sales taxes, and inventory taxes.

That said, it is worth repeating that, unless Rispone decides to voluntarily provide his personal and business tax returns, there is no way of knowing what, precisely, he had done under the imprimatur of his Nevada LLC for more than 15 years.

When he and his brother decided to convert the Nevada company to create a new entity in Louisiana, their attorney Loren Kleinpeter didn’t disclose any details about the number and the value of the business shares they were moving to their real home in Baton Rouge.

However, as previously mentioned, because Kleinpeter then named the new company as a member of ISC Constructors, it likely is worth a substantial amount of money merely because it is a member.

Outsider Businessman:

Eddie Rispone has repeatedly presented himself to voters as an outsider and a businessman who has created thousands of jobs and generated hundreds of millions of dollars in revenue in Louisiana, attempting to model his campaign directly off of the playbook written by Donald Trump. Indeed, it is likely he has mentioned Trump’s name more frequently than his own, and perhaps not surprisingly, Donald Trump also used shell companies in Nevada to squirrel away some of his assets.

To defenders of Trump and Rispone, the decision to create, on paper, a business in Nevada may seem to be a shrewd and perfectly legal way to minimize their taxes, but there is an important distinction between the two men: Unlike Rispone, Donald Trump actually owns and operates a tangible business in the state, the 64-story Trump International Hotel Las Vegas.

Eddie Rispone, on the other hand, paid a commercial service in Nevada for the use of their name and address in order to register a company that appeared to have only been in the business of holding a prominent spot on an Excel spreadsheet. Some may argue that, even if it’s perfectly legal, it’s still… what’s the word?…

Oh yes, phony.