“I do think there should be a rate difference. I am for gender as a rate-setting factor.”

So says Louisiana Insurance Commissioner Jim Donelon, who addressed the Baton Rouge Press Club on Monday, February 17.

Donelon, who has jurisdiction over life, health and accident, property and liability, marine and inland marine, fidelity and surety, and title insurance industries in the state, won his fourth full term last fall. He fended off a strong challenge by fellow Republican Tim Temple, taking 53% of the primary vote, compared to Temple’s 47%, with an 82,596 vote difference out of more than 1.1 million ballots cast.

That closer-than-he-expected result was generally believed to be due to the 75-year-old commissioner’s failure to go all-in on last year’s HB 372. Rep. Kirk Talbot’s “Omnibus Premium Reduction Act,” was – as the Bayou Brief reported thoroughly in our “Wrecked” series last spring – primarily nothing more than an excuse to enact tort reform. Donelon himself, when testifying about that bill in the House Insurance Committee last April, said he was unsure what auto insurance rate impact could be achieved by the bill’s lowering of the state civil jury trial threshold.

Now Donelon is singing from the “All We Need Is Tort Reform” hymnal.

“Ten years ago, Michigan was number one with the highest rates, and Louisiana was number two. Michigan fixed their program last year, and I am concerned that we will now be number one with the highest rates.”

Donelon says commercially-licensed transporters, such as big-rig truck drivers, especially loggers, ambulance drivers, and school bus drivers are reeling every time they renew their vehicle insurance policies, because they’re considered to be “deep pockets” when these $50,000+ civil suits get heard by a jury.

“We need to drop the jury threshold,” Donelon now says, “Since it results in defendants and their insurers handing out fifty-thousand-dollar checks like cotton candy to avoid trial. $5000 is better than $50,000, because it avoids nuisance lawsuits.”

The reprise of the Omnibus Premium Reduction Act is HB 9 in this upcoming session, authored by Rep. Ray Garofalo (R-Chalmette), and will first be heard not in the House Insurance Committee, but in House Civil Law. That’s because Civil Law’s chair and vice chair are Republicans, while the House Insurance committee chair and vice chair are Democrats. Each panel has Republican majority, but the chairman can determine when to call for the vote on the bill, potentially killing or advancing it when the full committee component is not in the hearing room.

Donelon told the Press Club that the omnibus bill is one of five in what he is calling “our reform effort,” adding, “If we do the five bills, we will see relief in 24 months.” The Commissioner maintains “This is not my idea: it was Kirk Talbot’s idea. His task force came up with it.”

Kirk Talbot (R-River Ridge) was last term’s House Insurance chairman. He has now been elected to the state Senate, and even though he’s a freshman in the upper chamber, the owner of Lucky Dogs, the ubiquitous New Orleans street corner hot dog carts, will now be chairing the Senate Insurance Committee. In 2018 Talbot authored a resolution asking the Insurance Department to “assemble a task force to address the high automobile insurance rates in the state.” The task force, composed of a chairperson from the Department of Insurance and four members from insurance companies, looked at changing the jury threshold, and predicted at best the rates might eventually drop 0.5%. Most of the other “tort reform”-linked proposals were evaluated in the task force report as “might be beneficial, but could not calculate the cost savings.”

Yet Donelon insists, at this most recent Press Club meeting, “Our system is broken in many ways, and therefore we’re going to address it in many ways.”

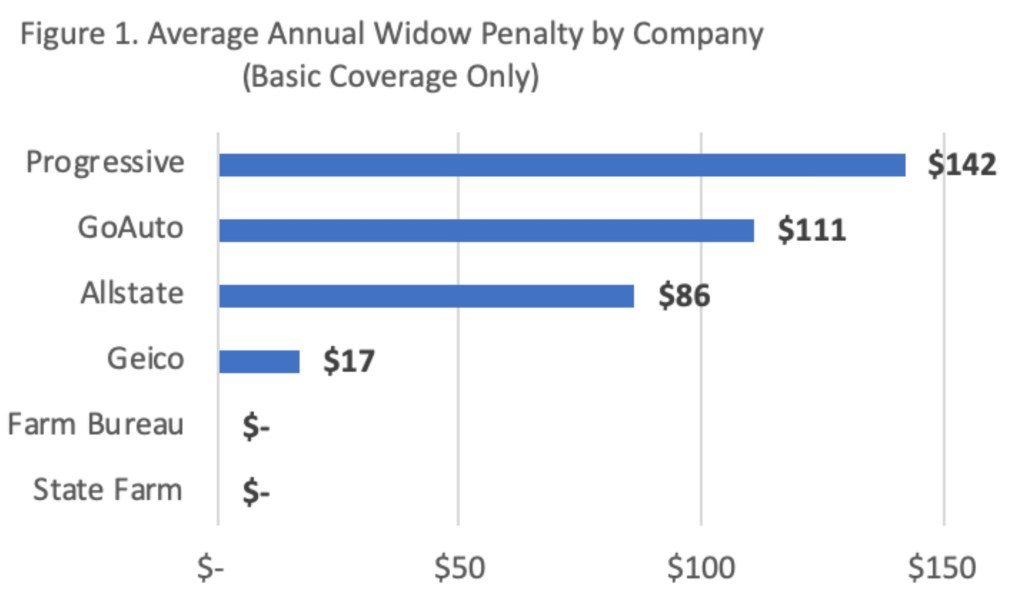

During the question-and-answer session that followed Donelon’s statements, I asked him about one of the many ways the companies have been documented to jack up rates, specifically the “widows’ penalty,” which our “Wrecked” series analyzed and which nationally-recognized consumer advocate Doug Heller testified about to the Louisiana Senate Insurance Committee last May.

“There is no such thing,” Donelon flatly told me. “Single women pay higher premiums than married women. It’s no different if you’ve never married, or divorced, or widowed. I don’t know if it’s the same for men, but I do know that it’s not because you are a widow. It’s because you are single.”

(Last fall, when he was still running for re-election, Donelon told the Sept. 16th meeting of the Baton Rouge Press Club that he would “be happy to support” a bill prohibiting the widows’ penalty, adding, “Know that it’s not being utilized by any companies in Louisiana today.”)

A journalist from the Baton Rouge Business Report pressed the issue this time. “Are you saying you agree with institutionalized gender discrimination?” she asked.

“Yes, I do. You know, it used to be against teenage males, because it was believed they were the more aggressive drivers. Now it’s just based on age, because all teens – boys and girls – are aggressive drivers. I do think there should be a rate difference. I am for gender as a rate-setting factor. I also think it’s right to charge more when the customer has a lower credit rating.”

Remarking that only Maryland and California prohibit the use of credit ratings in setting insurance rates, Donelon said that if Louisiana banned the credit factor, then everyone – even those who don’t “deserve” it – would have to pay higher rates.

“It’s not my fault that rates are where they are,” he said. “It’s not in the insurance companies’ best interest to lower rates.”

Yet Donelon and his department have sole authority to say yea or nay to the insurance companies’ rate hike requests, and they do so basically out of public view. He maintains that “Rate filings are public record, and say what the company is making and what their profit percentage is. And if their profits go up, their rates will necessarily go down.”

Sure.

It hasn’t always been some mysterious formula conjured up by alchemists and actuaries. Up until January 1, 2008, Louisiana had a public body known as the Insurance Rating Commission. Chaired by the state’s elected Insurance Commissioner, the IRC had six additional members appointed by the governor. This commission held regular public hearings on company requests to raise (or rarely, lower) insurance rates. The company had to justify – in a public forum – the reasons behind the request, and the Insurance Rating Commission was prohibited by law from approving a rate increase for any insurer more than once in any 12-month period.

Jim Donelon, who became Insurance Commissioner upon the resignation of J. Robert Wooley in February 2006,right after the twin disasters of Katrina and Rita, was the primary advocate for abolition of the IRC.

When Wooley left office, he was facing investigation for possible ethics violations.

Wooley had become Louisiana Insurance Commissioner in 2000, when the previous officeholder, Jim Brown, was convicted of lying to the FBI. Jim Brown had headed the Insurance Department since 1991, when his predecessor in the position, Doug Green, received a 25-year federal sentence for taking $2-million dollars in illegal campaign contributions from insurance companies doing business with the state.

And Doug Green had become Insurance Commissioner in 1988, after Sherman Bernard, who served in the post from 1972 to 1988, was convicted on federal extortion charges.

State campaign finance reporting requirements say Donelon’s comprehensive disclosure of his 2019 campaign contributors isn’t due till February 23, 2020, but it is known from his prior piece-by-piece filings that he received no less than a half-million dollars and potentially more than one million in campaign funds from the companies and agents of the insurance industry he regulates.

How does that fit with “discrimination”? Consider that word is defined as “prejudiced treatment or consideration of, or making a distinction towards, a being based on the group, class, or category to which they are perceived to belong.”